Buy a Business Loan

Buying a business? We’ve funded over 900 loans

Home »

See If You Pre-Qualify for an SBA Loan to Buy a Business – in 3 Minutes

Get the capital you need to fund your business

Fill in your info:

Ranked a Top 3 SBA franchise lender^

+$600 million franchise loans funded

+$2 billion in SBA loans since 2020

+2,000 SBA loans funded since 2020

Learn About Loans to Buy a Business

Talk to a business purchase loan expert today at (888) 828-5689. Get all your questions answered and get started with the dream of business ownership.

Understanding How to Buy a Business

Learn how to secure loans for buying businesses, covering planning, financing options like SBA loans, and navigating the purchase process.

Understanding How to Buy a Business

Learn how to secure loans for buying businesses, covering planning, financing options like SBA loans, and navigating the purchase process.

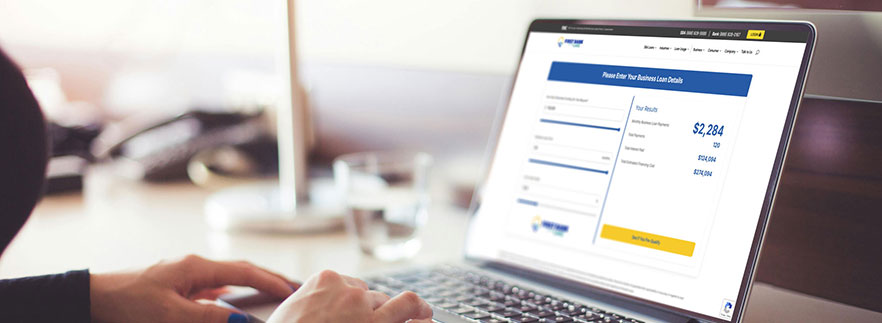

Use Our Business Loan Calculator

A business loan calculator helps entrepreneurs estimate monthly payments, interest costs,enabling informed decisions for loans like equipment, working capital or acquisitions.

Use Our Business Loan Calculator

A business loan calculator helps entrepreneurs estimate monthly payments, interest costs,enabling informed decisions for loans like equipment, working capital or acquisitions.

Free ePub: How to Buy a Business

Download our free guide to learn how to buy a business using SBA loans, explore loan rates, loan terms and business acquisition strategies.

Free ePub: How to Buy a Business

Download our free guide to learn how to buy a business using SBA loans, explore loan rates, loan terms and business acquisition strategies.

Buy a Business Loan Information

Loan to Buy a Business

Loan to Buy a Business

Securing a loan to buy a business is a strategic option for entrepreneurs who want to step into an established operation rather than building one from the ground up. This article looks into the fundamentals of financing business acquisitions, and explains how the right loan structure can help reduce common startup risks such as unpredictable revenue and unproven business models. Today, business acquisition loans are accessible through traditional lenders, as well as government-backed programs like offered by the Small Business Administration (SBA), making it essential for prospective buyers to understand their options.

A well-structured loan to buy a business creates immediate value by enabling buyers to purchase proven operations, existing customers and a reliable cash flow, all of which help to strengthen lender confidence in the transaction. For instance, acquiring a small retail operation or a service-based firm can provide quicker returns compared to launching a new business. However, navigating the options requires careful consideration of eligibility, terms, and potential pitfalls. Whether you are purchasing a family-owned business or a franchise, SBA loan programs can help bridge the financing gap, often with down payments as low as 10%. We will explore the full range of financial options, from loan types to application strategies, providing you the knowledge to make informed decisions in the current lending environment.

Economic stability often makes these loans attractive, with interest rates for SBA-backed financing influenced by the prime rate. Yet, success hinges on thorough due diligence, and assessing the target company’s financial health, market position, and growth potential. A loan to buy a business isn’t just about capital – it’s about aligning financing with your vision for expansion and profitability. As we proceed, we’ll unpack the key elements to help you secure the right loan tailored to your goals.

Types of Loans Available for Business Acquisitions

When pursuing a loan to buy a business, the array of financing options can seem overwhelming, but focusing on the most reliable and accessible choices simplifies the process. At the forefront are SBA loans, which dominate the market for their government guarantees that reduce lender risk and, consequently, borrower costs. The SBA 7a program, in particular, stands out as a versatile tool for acquisitions, allowing loans up to $5 million or more to cover not only the purchase price but also working capital, inventory, and debt refinancing. This makes it an ideal loan for those targeting small to mid-sized enterprises, where the funds can be disbursed in phases to match the acquisition timeline.

Complementing the 7(a) loan is the SBA 504 loan, designed specifically for fixed-asset heavy purchases, like real estate or equipment integral to the business being acquired. With terms extending up to 25 years and competitive fixed rates, this option provides long-term stability, enabling buyers to preserve cash flow for operational improvements post-purchase. For example, if you’re acquiring a manufacturing firm with substantial machinery, a 504 loan could cover 40% of the project costs through a Certified Development Company (CDC), with a bank handling 50% and your equity injection at 10%.

Beyond SBA offerings, conventional bank loans from major institutions offer another avenue for loans to buy a business. These typically feature competitive rates and are suited for borrowers with strong credit profiles. Conventional loans often require detailed valuations of the target business, emphasizing cash flow projections to ensure repayment feasibility. While approval might take longer, these loans provide flexibility without the SBA’s size restrictions, making them a solid business loan for larger deals.

Seller financing emerges as a hybrid approach, where the current owner extends a loan directly, often at favorable rates over several years. This not only eases the buyer’s cash outlay but also signals the seller’s confidence in the business’s future, potentially reducing due diligence hurdles. Earn-outs, tied to post-acquisition performance, can further align interests, making this a creative way to buy a business for negotiations involving intangible assets like goodwill.

For rural or underserved areas, USDA Business & Industry (B&I) loans provide guarantees similar to the SBA, with terms up to 30 years and competitive rates. These are particularly useful for acquiring businesses in non-metro regions, fostering economic development while offering a reliable buy a business loan option.

Rollovers for Business Startups (ROBS) using your 401(k) funds represent a non-debt alternative, allowing tax-free access to retirement savings without penalties. While not a traditional loan to buy a business, it complements other financing by covering down payments, though it carries risks like depleting personal reserves.

In evaluating these types, consider the business’s specifics like a service-oriented acquisition might favor a 7a loan for its working capital flexibility, whereas asset-intensive deals lean toward 504 structures. Hybrid models, combining SBA guarantees with bank terms, often yield the best outcomes, balancing cost and accessibility in the lending market.

Eligibility and Qualification Criteria

Qualifying for a business loan demands a multifaceted assessment, starting with the borrower’s profile and extending to the target enterprise’s viability. SBA requirements set the benchmark, mandating that the business operates for profit, is U.S.-based, and meets size standards—typically under 500 employees or revenue thresholds varying by industry. Lenders also scrutinize personal credit, favoring scores of 680 or higher, alongside a demonstrated ability to manage debt, evidenced by a debt service coverage ratio (DSCR) of at least 1.25x.

Net worth and liquidity are also important; applicants must show sufficient personal resources to inject 10-25% equity, 3 verifying sources to avoid untraceable funds. For a business loan, this equity signals commitment, reducing lender exposure. Ownership structure matters too, as U.S. citizenship or permanent residency is required, with personal guarantees from all principals holding 20% or more stake.

The target business’s eligibility is equally critical. It must not fall into ineligible categories like speculative real estate or gambling operations. You will also need to share historical financials, tax returns, balance sheets, and cash flow statements from the past three years. Environmental reviews and appraisals ensure no hidden liabilities, particularly for asset-based loans. Having industry experience may strengthen applications as lenders prefer buyers with relevant backgrounds, to mitigate some of the operational risks in the loan. For SBA options, the business must demonstrate inability to secure reasonable terms elsewhere, a criterion often met through bank denial letters.

Updates in lending practices emphasize beneficial ownership disclosure to enhance transparency. This adds a layer of compliance but supports secure transactions. To qualify, compile a robust business plan outlining the acquisition rationale, integration strategies, and growth forecasts. This narrative, supported by market analysis, convinces lenders of the venture’s sustainability. For those falling short on credit, co-signers or collateral can tip the scales, turning a marginal business loan application into an approval. Ultimately, eligibility blends personal financial health with business potential, requiring proactive preparation to navigate the lending framework.

The Application Process Step by Step

Starting the application for a loan to buy a business involves a systematic approach to gather documentation, engage lenders, and finalize terms.

- Begin with self-assessment: Review your credit report, calculate net worth, and value the target business using methods like asset-based or earnings multiples. This groundwork informs which business loan suits—SBA for guarantees or conventional for speed.

- Select a lender like First Bank of the Lake with deep experience in acquisitions. Pre-qualification offers rate estimates without hard inquiries, streamlining options.

- Documentation is the core: Submit personal financial statements (SBA Form 413), tax returns, resumes, and a detailed business plan. For the target business, include purchase agreements, appraisals, and three years of financials. SBA applicants need Form 1919 for borrower info.

- Underwriting follows next and this is where lenders analyze DSCR, collateral, and risks—expect 30-90 days for SBA, shorter for banks. Address questions, concerns and requests for additional information promptly to avoid delays.

- Upon approval, review the commitment letter for rates, fees, and financial or reporting covenants. Closing involves signing, and disbursing funds via escrow for acquisitions.

- Post-closing, monitor compliance, such as annual reporting for SBA loans. This process, while rigorous, secures a business loan that aligns with your goals.

Costs, Rates, and Associated Risks

The financial implications of a loan to buy a business extend beyond the principal, encompassing rates, fees, and inherent risks. SBA 7a rates are often variable and tied to the prime rate, while fixed options provide predictability. Conventional business loans might offer competitive starts, but without guarantees, they carry higher scrutiny. Fees include SBA guarantees (typically 2-3.75% of the backed portion), origination charges, and appraisals. These can total several percent of the loan, which is often financed with the loan proceeds.

Risks involve default, where personal guarantees expose assets, or interest rate fluctuations impacting cash flow. Overleveraging strains operations, especially if the acquired business underperforms. Market shifts or integration issues amplify these, underscoring the need for contingency planning in any business loan. Tax deductions on interest mitigate costs, but higher rates from alternative sources pose long-term burdens. Balancing affordability with risk ensures sustainable growth. In conclusion, a business loan empowers strategic growth. By leveraging SBA and other options, you can achieve ownership with managed risks. Consult experts to tailor your buy a business loan path.

About First Bank of the Lake

The friendly financial experts at First Bank of the Lake offer SBA loans designed with the needs of our customers in mind. We financed more than $600 million in SBA loans over the past 12 months and are ranked as the 15th largest SBA lender in the United States in 2024. Since our founding in October 1985, we have offered outstanding customer service and the best financial options for their needs. Today, First Bank of the Lake offers loans for business enterprises across the United States. To learn more about our bank or about SBA loans, visit our website or check us out on Facebook or LinkedIn. Our friendly and knowledgeable staff members will be happy to discuss your loan options with you and to help you achieve the highest degree of success in your chosen industry. Please contact us at (888) 828-5689 to get your business loan questions answered today!

Loan to Buy a Business Checklist: A Step-by-Step Preparation Guide

Loan to Buy a Business Checklist: A Step-by-Step Preparation Guide

Securing a loan to buy a business demands preparation to maximize approval chances and obtain favorable terms. This comprehensive checklist provides numbered steps to guide prospective buyers through acquiring an existing company, whether a small retail shop, service firm, or larger operation. Following these steps helps present a professional, credible application to lenders, including banks and SBA-approved institutions.

- Define Your Acquisition Goals and Budget Start by identifying the type and size of business you want to purchase. Research industries that align with your experience and goals. Determine a realistic budget by estimating the total cost which is the purchase price, goodwill, inventory, equipment, real estate, working capital, and closing fees. Factor in your available personal funds for the down payment (typically 10-30%). Create a clear use-of-funds summary to justify the loan amount as this prevents overborrowing and ensures the loan matches your strategic vision.

- Conduct Preliminary Due Diligence on Target Businesses Before committing, evaluate potential businesses through brokers or listings. Review financials like tax returns, profit/loss statements, balance sheets, customer base, contracts, leases, and liabilities. Engage professionals like your accountant and attorney for initial valuation using methods like asset-based, earnings multiples, or discounted cash flow. Identify red flags such as declining revenue or legal issues. Strong due diligence strengthens your loan application by demonstrating informed decision-making.

- Assess Personal Credit and Financial Readiness Obtain credit reports from major bureaus and aim for a score of 680 or higher. Pay down debts and correct errors to improve your profile. Calculate personal net worth and liquidity using SBA Form 413 or similar templates. Prepare for personal guarantees, which are required for most loans to buy a business. If credit is weak, explore ways to strengthen it, such as adding a co-borrower with strong finances.

- Research and Select Suitable Loan Types Explore options like SBA 7a loans that feature flexibility for goodwill and working capital as well as SBA 504 loans for fixed assets like real estate. Compare terms, rates, and eligibility. SBA loans often require the business to meet size standards and demonstrate inability to obtain conventional financing. Prioritize programs that align with the acquisition’s asset mix and your credit profile.

- Develop a Detailed Business Plan Craft a professional plan outlining the acquisition rationale, market analysis, competitive advantages, post-purchase operations, management team, and financial projections (cash flow, profit/loss, balance sheet for three to five years). Include integration strategies and growth initiatives. For most loans to buy a business, emphasize how existing revenue will support repayment and this document is critical for convincing lenders of viability.

- Gather Comprehensive Documentation Compile personal items: tax returns for three years, resumes, personal financial statements, and proof of down payment sources. For the target business you will need financial statements, tax returns, purchase agreement draft, appraisals, environmental reports, and inventory lists. Prepare SBA-specific forms like Form 1919 for borrower information if applicable. Organize it all digitally and physically to expedite submission and revisions.

- Identify and Contact Experienced Lenders Contact a lender like First Bank of the Lake for pre-qualification discussions. Provide an executive summary of your plan to gauge interest and receive feedback. Building relationships early gives you professional insight and assists to improve terms for your loan.

- Secure Professional Valuations and Appraisals Hire independent appraisers for the business, real estate, and equipment. Obtain environmental assessments if required. These reports validate the purchase price and protect against overvaluation, a frequent lender concern in loans to buy a business involving significant assets or goodwill.

- Negotiate the Purchase Agreement with Financing Contingencies Work with an attorney to draft or review the letter of intent and purchase agreement. Include contingencies for financing approval, due diligence satisfaction, and clear allocation of assets/liabilities. Align closing timelines with expected loan processing times typically 30-90 days for SBA. This protects your interests while demonstrating seriousness to sellers and lenders.

- Submit Applications and Supporting Materials Complete lender forms accurately and submit with all documentation. Include a cover letter summarizing strengths. For SBA loans, route through an approved lender. Follow up on receipt confirmation and be prepared to provide additional details promptly during initial review.

- Navigate Underwriting and Respond to Requests Underwriting involves detailed risk analysis, possibly including site visits, third-party reports or seller interviews. Respond quickly to information requests to avoid delays. If concerns arise, offer solutions like adjusted terms, larger equity injection or additional collateral. Patience and proactive communication often determine final approval for a loan.

- Review Approval Terms and Close the Deal Upon conditional approval, scrutinize the commitment letter for rates, fees, covenants, and conditions. Consult advisors before accepting. Coordinate closing with the seller, lender, and escrow agent. Ensure funds disburse correctly and comply with post-closing requirements, such as insurance or reporting.

- Plan Post-Acquisition Management and Repayment After funding, implement your integration plan, monitor cash flow, and maintain lender communication. Use loan proceeds strictly as approved. Strong early repayment builds credit for future needs and ensures long-term success following your loan.

By systematically following these steps, you position yourself for a successful acquisition. Preparation minimizes risks, enhances credibility, and increases the likelihood of securing the right loan to buy a business.

Loans to Buy a Business FAQs

Loans to Buy a Business FAQs

1. What is a loan to buy a business?

These loans are financing specifically designed to fund the acquisition of an existing company by covering expenses such as the purchase price, working capital, inventory, or real estate. Options like SBA 7a loans provide up to $5 million or more with government guarantees, lower down payments often 10-20%, and terms up to 25 years, making them ideal for buyers seeking established operations with proven cash flow.

2. How does an SBA 7a loan work for buying a business?

The SBA 7a loan is the most popular option for a loan, offering flexibility for acquisitions, goodwill, and operational needs. The SBA guarantees up to 85% of the loan, encouraging lenders to approve borrowers who might not qualify for conventional loans. Terms can reach 10-25 years, with funds usable for full purchases or partial ownership changes.

3. What are the main types of loans to buy a business?

Primary types include SBA 7a and 504 loans for broad or asset-focused acquisitions, conventional bank term loans for credit-strong buyers, seller financing where the owner carries a note, and USDA B&I loans for rural businesses. Each offers different terms, rates, and down payment requirements tailored to acquisition needs.

4. What credit score is needed for a loan to buy a business?

Most lenders prefer a personal credit score of 680 or higher for a loan, especially SBA options. Scores as low as 600-650 may qualify with strong compensating factors like industry experience, substantial equity injection, or robust business cash flow projections demonstrating repayment ability.

5. How much down payment is required for a loan?

SBA-backed loans to buy a business typically require 10-20% equity injection, with 10% common for established operations. Conventional loans may require up to 20-30%. The injection must come from verifiable sources, showing buyer commitment and reducing lender risk in financing the acquisition.

6. Can I use the loan to purchase goodwill or intangible assets?

Yes, SBA 7a loans explicitly allow funding for goodwill, customer lists, and other intangibles up to certain limits, often up to 50% of the loan. This makes them particularly suitable for service-based or professional practice acquisitions where tangible assets are minimal but value lies in established clientele.

7. What documents are required for a loan to buy a business?

Essential documents include personal financial statements (SBA Form 413), three years of tax returns, a detailed business plan with projections, purchase agreement, target business financials (tax returns, P&L, balance sheet), resumes, and appraisals. Thorough documentation proves both buyer capability and target business viability.

8. How long does it take to get approved for a business loan?

Approval timelines vary – SBA loans to buy a business typically take 30-90 days due to underwriting and guarantee processing. Conventional bank loans may close in 45-60 days, while seller-financed deals can be faster. Early preparation and experienced lenders significantly shorten the process.

9. Are personal guarantees required for loans to buy a business?

Yes, nearly all loans to buy a business require unconditional personal guarantees from owners with 20% or greater stake. This pledges personal assets as collateral if the business defaults. Even with strong business cash flow, lenders seek this protection for acquisition financing.

10. Can startups or first-time buyers qualify for a business loan?

First-time buyers can qualify if they demonstrate relevant industry experience, management skills, or a strong business plan. SBA loans to buy a business favor acquisitions over startups because existing revenue reduces risk. Higher equity injections like 15-30%, may apply for less experienced buyers.

11. What fees are associated with these business loans?

Common fees include SBA guarantee fees (2-3.75% of the guaranteed portion), origination fees (1-3%), appraisal and environmental reports ($1,000-$5,000+), closing costs, and legal fees. Many can be financed into the loan, but they increase the total cost of acquisition financing.

12. Can I finance 100% of the purchase price with a business loan?

Full financing is rare but possible through combinations like SBA loans covering up to 90%, plus seller financing for the remainder. Most require 10-20% buyer equity. ROBS / 401(k) rollovers can fund down payments without debt to approach near-100% leveraged purchases.

13. How does seller financing work alongside a loan to buy a business?

Seller financing complements bank or SBA loans by covering gaps, often 10-30% of the price at favorable rates over 5-10 years. It reduces buyer cash needed, signals seller confidence, and can make the overall deal more attractive to primary lenders evaluating the acquisition.

14. What risks should I consider with a business loan?

Key risks include overpaying for the business, underestimating integration costs, personal liability via guarantees, and cash flow shortfalls if projections miss. Thorough due diligence, realistic forecasts, and contingency planning are essential to mitigate default risk and ensure successful repayment.

Want to learn more about buying a business?

Getting a Loan to Buy a Business

Acquiring a business offers growth but involves costs, challenges and financing.

Loan to Buy Out a Partner

Partner buyouts can strain small business liquidity but SBA loans offer flexibility and support.

How to Buy a Franchise Business

Franchising offers entrepreneurs proven models, support, and financing options like SBA loans.

Get a Veterans Loans to Buy a Business

Veterans can use SBA loans to buy a business with flexible terms and down payments.

M&A Loans For a New Business

Mergers fuel growth and opportunity. SBA loans provide the flexible financing.

How to Buy a Franchise Business Epub

Learn franchise buying essentials like how to buy the right franchise and handle financing.

Industries to Buy a Business In

Look at 30 different industries that we support with SBA 7a and 504 loan financing.

Business Acquisition Loan Closings

Discover the key documents for your closing like the LOI, business plan and the financing.

Get an SBA Loan

Partner with a top SBA lender that offers flexible loans and expert guidance to grow your business.

Want to learn more about business loans?

SBA 7a Loan Requirements

Finding the right funding solutions for your small business can be challenging. SBA 7a loans offer low interest rates and fixed-rate or variable-rate options.

SBA 504 Loan Requirements

What are 504 loans? This guide will provide you with an overview on how to get a 504 loan, SBA 504 loan down payment requirements and finding the right SBA 504 loan lenders for your small business needs.

How to Get an SBA Franchise Loan

Are you an entrepreneur looking to start a franchise but need funding to get started? Securing a Small Business Administration loan might be the perfect solution.

Real business owners. Real results.

Woof Gang Bakery SBA Loan Case Study

After years in HR, Kasia followed her passion for animals and, with a $345K SBA loan from First Bank of the Lake, quickly launched her Woof Gang Bakery & Grooming franchise — already nearing breakeven just months in.

Tint World SBA Loan Case Study

After losing his wife, a friend, and his life savings, Dan Billings reinvented his life with a Tint World franchise — and with guidance and an SBA loan from First Bank of the Lake, his business is thriving and he’s already eyeing a second location.

Lifetime Green Coatings SBA Loan Case Study

Father and son duo Barry and Parker Norfleet launched six Lifetime Green Coatings franchises with a $400K SBA loan from First Bank of the Lake — quickly setting up operations and nearly breaking even within just three months.

What Our Customers Say

Gave Me the Confidence I Needed

Huge thanks to Tammy and Brandi. Tammy was my first point of contact and gave me the confidence I needed since there isn't a local branch near where I live. Brandi has been answering ALL my questions since and has excellent follow up and has taken great care of me.

— Michele Houston

Genuinely Interested in Helping My Business Succeed

First Bank of the Lake was a tremendous help in securing a 504 small business loan for my company. Every staff member I interacted with was professional, friendly, and genuinely interested in helping my business succeed.

— Don Kamb

Exceptional Service

I cannot say enough positive things about my experience working with Eric as my SBA loan officer. From start to finish, he provided exceptional service and went above and beyond to ensure that every issue we encountered was resolved quickly and efficiently.

— Bryan Crowe